- Image via Wikipedia

In October, when Bill Ackman and Pershing Square Capital disclosed an 11% stake in Fortune Brands(FO), there was speculation that he would push the conglomerate to break up. Today, Fortune announced plans to break into three companies.

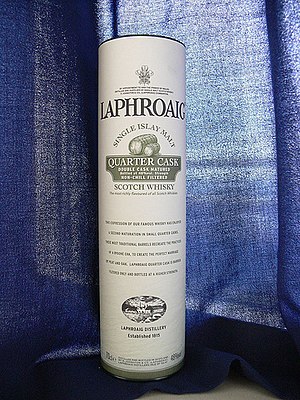

Fortune itself would retain its Premium Spirits business, led by venerable brands such as Jim Beam, Maker’s Mark, and Laphroaig. This business has $2.5Billon in annual revenue making it the largest US-based spirits company.

The company will spin off its Home & Security business, which includes Moen faucets, Kitchen Craft cabinets, Therma-Tru doors and MasterLock, as well as other leading brands. This group features over $3Billion in annual sales and, as the company notes “will have substantial leverage and upside growth and returns potential as the U.S. housing market recovers.”

Fortune will spin off or sell its golf business, Acushnet. Acushnet is the #1 golf company in the world, with $1.2Billion in annual sales. Brands include Titleist and FootJoy.

The company says it arrived at this conclusion following a four year strategic review, and will develop a comprehensive plan for executing the spinoffs over the next few months. This looks to be a classic conglomerate breakup, and could create excellent opportunities for investors.

Disclosure: The Author holds no position in any stock mentioned

Related articles

- Fortune Brands Plans to Split Up (online.wsj.com)

- Fortune Brands Said to Plan a Split Into Three Units (businessweek.com)

- Fortune Brands to Split Up (dealbook.nytimes.com)

If anyone is interested: you have to really over-extend the sum-of-the parts analysis to get this deal to pencil out from ~$60….this isn’t just a no-brainer as the SUNH spin was.