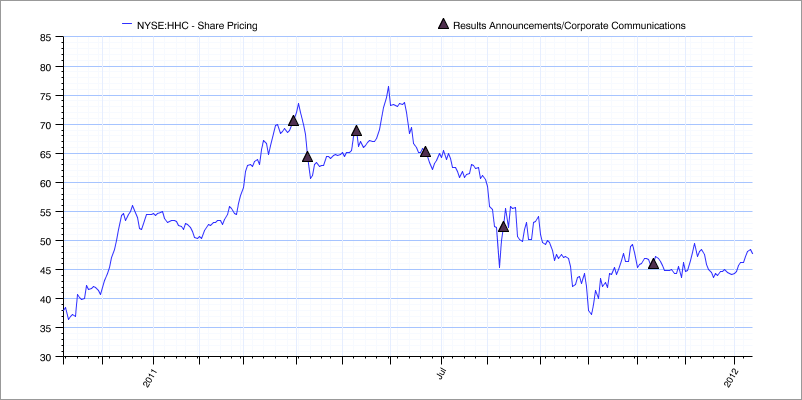

It has been quite a wild ride for the company – a relatively quick double followed by a steady descent after some earnings ‘disappointments’. Has anything really changed though? Whitney Tilson, head of T2 Partners, sure doesn’t think so. In fact, the company is still listed as a Top 10 position in the firm’s recently published annual letter (the company is discussed on page 15, but the letter is worth reading). T2 estimates intrinsic value of HHC at $77-$141, a sizable premium to the current share price. To read more about T2’s analysis of HHC, check out this July presentation put out by the fund.

I find that investing in real estate (and their associated stocks) can be a tricky game. While a solid understanding of the properties and their potential is crucial, the economic environment surrounding them is just as important. It is worth noting that the insiders, including Brookfield Asset Management (BAM) and Bill Ackman at Pershing Square, are still hanging on here. It even looks like some directors have been buying a little bit over the past few months. The bottom line is HHC is still full of the same high risk-high reward assets as it was at the time of its spinoff and given their nature, a year is a bit too short of a time frame for those assets to be judged. I would recommend patience here and view the decline as a chance to get back in at a more attractive price as opposed to having had to chase it up immediately post-spin.

Disclosure: Author currently holds no position in any stock mentioned.