Founded by Steven and Mitchell Rales, Danaher Corporation(DHR) is one of the most successful business stories of the last three decades. One of just 44 companies with a cumulative total return of greater than 10,000% over that time period(it’s the 6th best performer)…

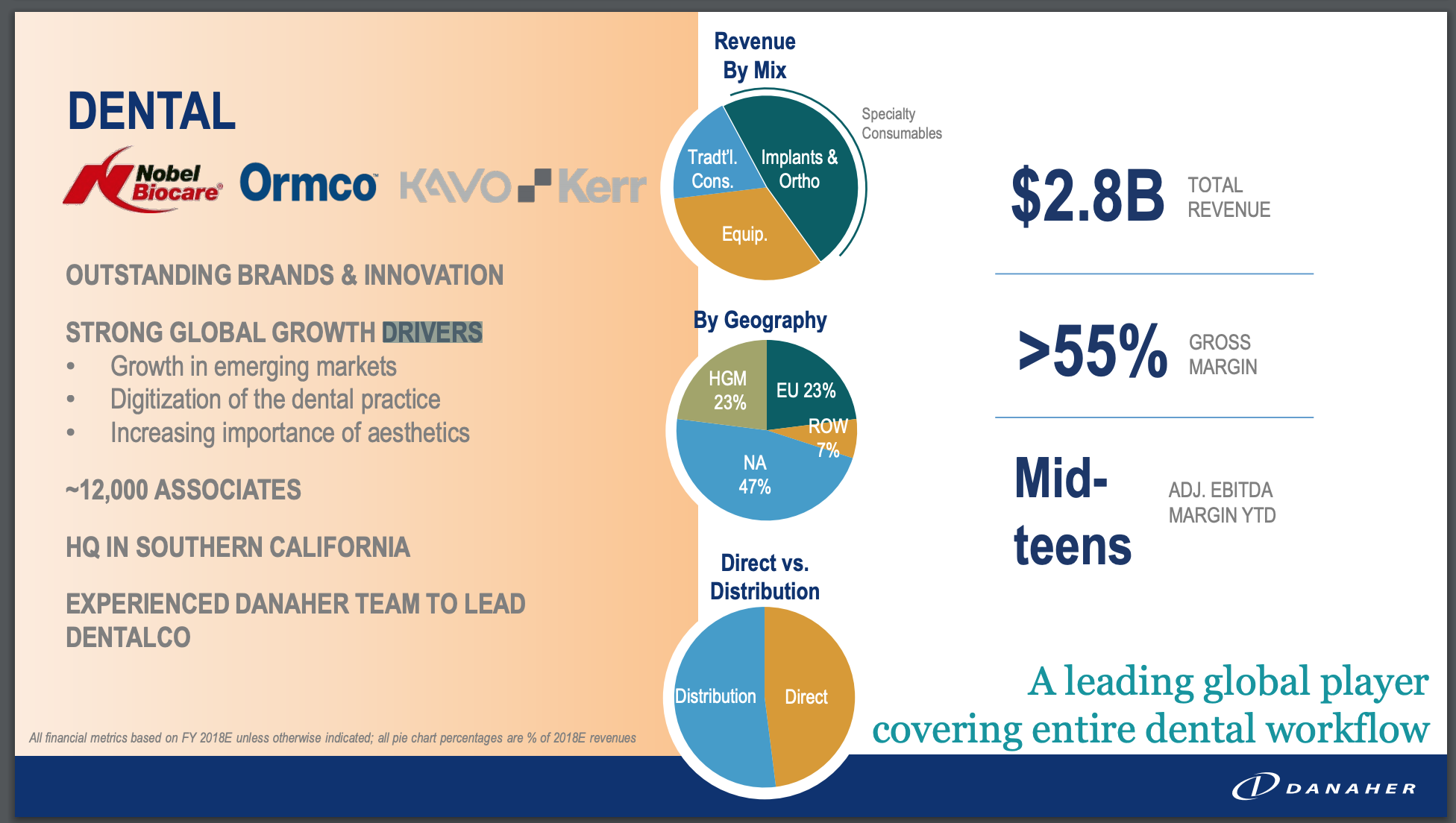

Just two years later, Danaher announced another spinoff last summer, this time of its Dental Business. The spinoff of DentalCo(we assume a new name will be forthcoming), is expected to take place in the second half of this year and should be tax free to shareholders. DentalCo, which had $2.8 billion in revenue in 2017, will comprise of Nobel Biocare, Ormco, and KaVo Kerr. The company will have 12,000 employees. It will be led by Amir Aghdaei as President and CEO.

Amir Aghdaei will become President and Chief Executive Officer of DentalCo upon completion of the transaction, and will join DentalCo’s Board of Directors. Mr. Aghdaei joined Danaher in 2008 and currently serves as Group Executive with responsibility for the Dental segment.

Two other Danaher leaders will join Mr. Aghdaei on DentalCo’s Board of Directors while retaining their roles at Danaher: Dan Daniel, Executive Vice President, and Daniel Raskas, Senior Vice President, Corporate Development. In addition, Dan Comas, Danaher’s Executive Vice President and Chief Financial Officer, will serve as a special advisor to DentalCo post-spin.

Mr. Aghdaei stated, “I am incredibly honored and excited to lead our Dental business as a standalone public company. Our team’s commitment to execution and continuous improvement provide a strong foundation for meaningful value creation going forward. We intend to build upon and reinforce our common culture ― the Danaher Business System ― and will continue to deliver world-class innovation, service and solutions for our customers. This is a tremendous opportunity to enhance our strategic position, and I look forward to leading the team through this important milestone.”

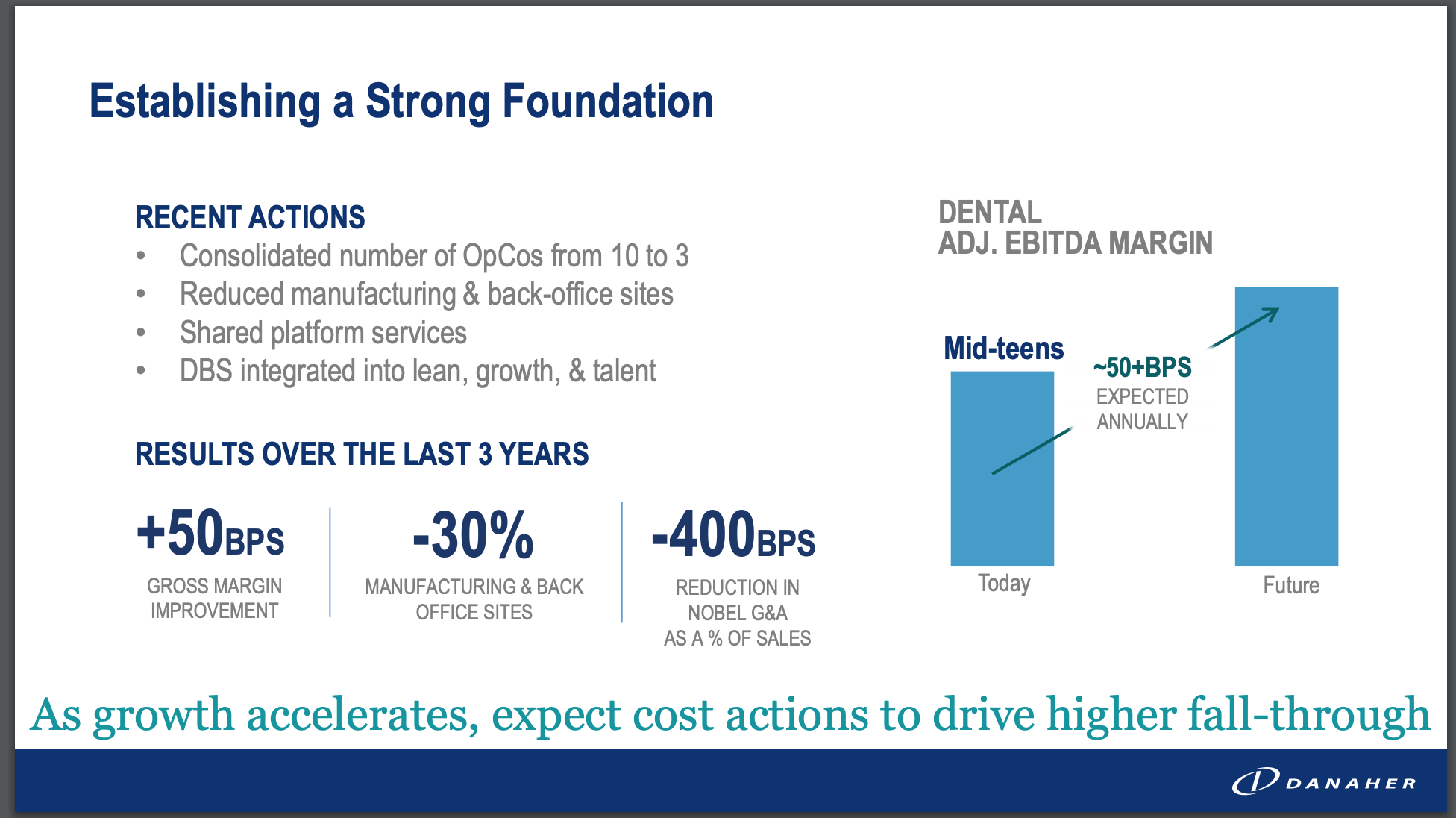

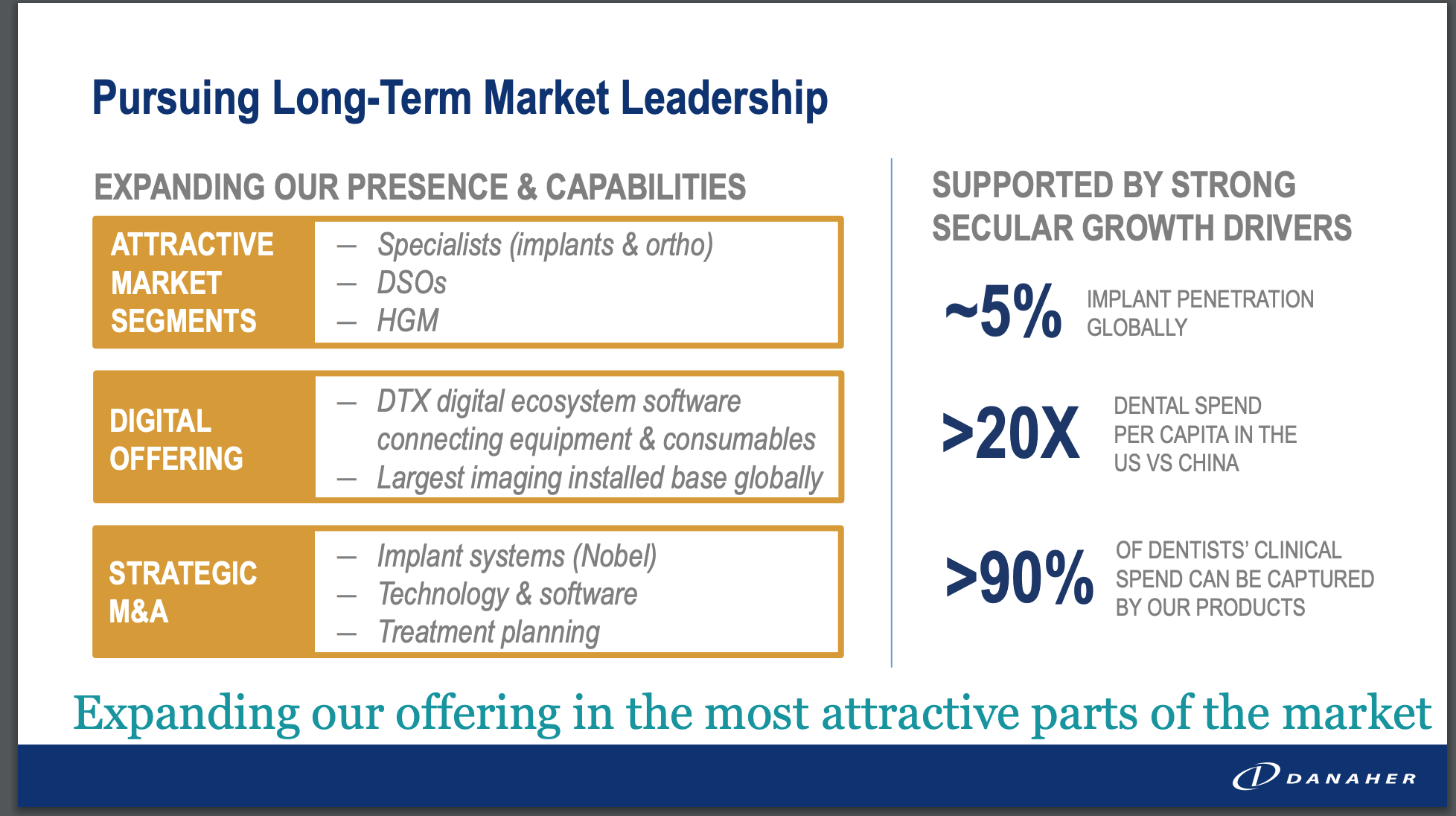

At Danaher’s recent investor day, a more detailed overview of DentalCo was provided. Gross margins are around 55% and EBITDA margins in the mid-teens. The company has many avenues for growth including a system called Spark that appears to be a competitor to Align Technology(ALGN).

Disclosure: The author holds no position in any stock mentioned

Likes